Breaking ChatGPT’s Bitcoin FUD #1: Government Regulation…

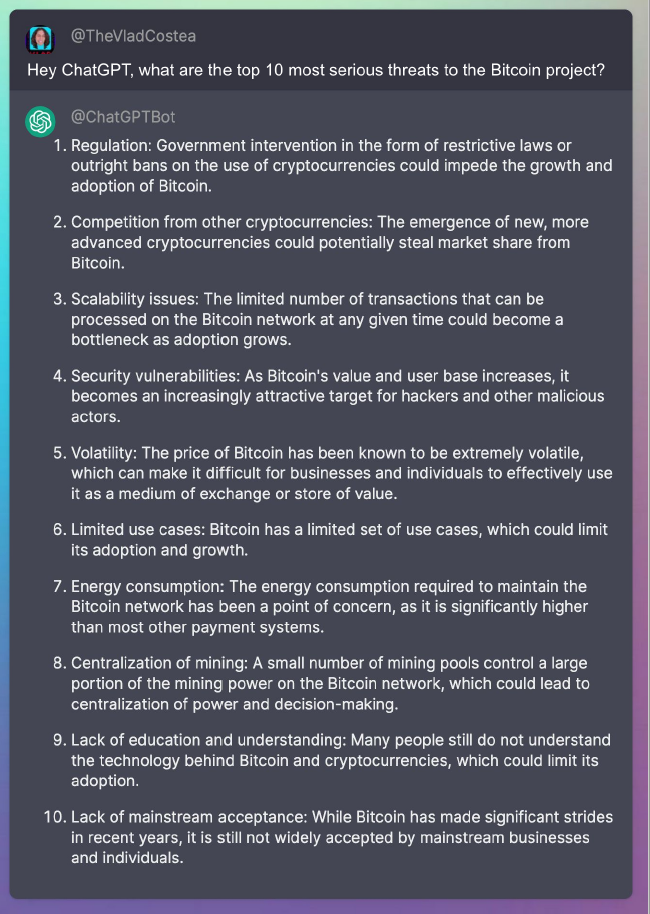

What are the biggest threats that can derail Bitcoin? Vlad asked ChatGPT. The answer he got is below. I asked the same question and here is what I got:

“Me: Hey ChatGPT, what are the top 10 most serious threats to the Bitcoin project? ChatGPT: As of my knowledge cutoff in September 2021, here are ten potential threats that were considered serious for the Bitcoin project:- Regulatory challenges: Governments around the world could introduce restrictive regulations or outright bans on cryptocurrencies, which could impact the adoption and use of Bitcoin.

- Security vulnerabilities: Bitcoin’s security relies on the integrity of its underlying technology. If new vulnerabilities or exploits are discovered, it could undermine confidence in the network.

- Quantum computing: The development of powerful quantum computers could potentially break the cryptographic algorithms used in Bitcoin, threatening the security of transactions.

- Competition from other cryptocurrencies: The emergence of new cryptocurrencies with innovative features or improved scalability could pose a threat to Bitcoin’s market dominance.

- Scaling issues: Bitcoin’s scalability has been a topic of concern. As more users join the network, transaction processing times and fees could increase, potentially limiting its practical use.

- Lack of mainstream adoption: Widespread adoption by businesses and individuals is crucial for Bitcoin’s success. If it fails to gain significant acceptance as a form of payment, its long-term viability could be at risk.

- Environmental impact: Bitcoin mining consumes a significant amount of energy, primarily due to the proof-of-work consensus mechanism. Concerns about its carbon footprint and environmental impact could lead to pushback against the network.

- Forks and governance disputes: Disagreements within the Bitcoin community on network upgrades, scaling solutions, or governance could result in contentious hard forks, potentially creating multiple competing versions of Bitcoin.

- Loss of user funds: Bitcoin’s decentralized nature means that users are solely responsible for securing their private keys. If individuals lose access to their keys or fall victim to scams or hacks, it can result in irreversible loss of funds and damage to trust.

- Market volatility and price manipulation: Bitcoin’s price volatility poses risks to both investors and the overall perception of the cryptocurrency. Market manipulation and speculative trading practices could undermine its credibility.

It’s important to note that the cryptocurrency landscape is highly dynamic, and new threats or challenges may have emerged since my knowledge cutoff. Therefore, it’s advisable to stay informed about the latest developments in the field.”

In this next part of the “Breaking FUD” series by Vlad Costea, he begins to take on the top 10 threats according to ChatGPT. This excerpt is from the e-magazine issue “BTCTKVR 3: Breaking FUD”, released May 2023. I’ll keep posting the rest of this e-magazine over the coming days.

Here is what Vlad got out of ChatGTP:

“

When I asked ChatGPT to provide a list of top 10 biggest threats to the Bitcoin project, the concept of regulations was at the absolute top. According to the AI’s thesis, restricted access and outright bans have the potential to impede the adoption and growth of Bitcoin.

On the surface, these concerns seem legitimate. But if you understand how internet privacy and Bitcoin operate, then you will realize that only government-regulated businesses that facilitate the purchase and sale of bitcoin are really affected. They can shut down Coinbase, Binance, eToro, Kraken, Bitfinex, and every other business which operates under a jurisdiction that becomes hostile. They can also severely punish individuals using such services by closing down their bank accounts and lowering their social credit scores to a point where many of their freedoms go away. But these are all social contract problems which have nothing to do with the Bitcoin network.

In most countries around the world (and with a handful exceptions), the government can’t stop a private citizen from owning a computer, accessing the internet, and running free open-source software. In the constitutions which provide and protect individual freedom, computer code is regarded as free speech and access to information is a fundamental human right. Sure, specific bans can be put in place to cover the Bitcoin software – but what is Bitcoin if not software and pure mathematics? It’s not like the client can’t be rewritten from scratch in another programming language and under a different name, while respecting the same consensus rules. And if the connection to the Bitcoin network itself gets banned, obfuscation technologies such as Tor, Nym and VPNs come in handy. Even in the absence of internet access, there’s serious development to be found in the field of mesh antennas and satellite communications. Currently, Blockstream rents a satellite which broadcasts information about the latest Bitcoin transactions. Anyone who acquires or builds a parabolic antenna (most commonly used by people to get access to distant television channels) is able to get information about the Bitcoin network without needing internet access. In the future, we can also imagine scenarios where mesh antennas are set up within reasonable distances in order to act as a permanent backup for the otherwise fragile internet infrastructure. And if all of these plans fail, there’s also ongoing research about broadcasting Bitcoin transactions through short-wave radio signals – the same technology that was being used during the Cold War to send propaganda across national borders, now reimagined for Bitcoin. On the other hand, we should be aware that Bitcoin dies the moment people stop using it. In and of itself, no technology has any meaning and it’s the individuals who adopt it that project purpose and goals towards it. Accordingly, Bitcoin can be effectively killed if a government ban leaves people apathetic about the project. In the absence of freedom fighters who care about keeping the governments away from their personal affairs, Bitcoin can’t succeed.

Nonetheless, Bitcoin will succeed in spite of all political pressures and bans…for as long as it provides freedom of transactions and a safe haven from confiscation. Should exchanges and registered businesses get banned, price discovery would take a hit. Such a situation leads to difficulty in pricing goods and services, so local or regional denominations need to be set according to the supply/demand ratio. Maybe that 1 bitcoin will be harder to valuate in

However, the example presented is too broad. There are two extreme cases where banning Bitcoin makes sense from a government’s point of view: when the fiat currency’s hegemony is being threatened (as is the case of the United States of America), and when the ability to control the country’s finances in times of crisis becomes severely undermined by people opting out (such as Nigeria and Argentina in 2023).Bear in mind that the first example presented above concerns the world’s first modern democracy and the government which consciously makes efforts to export human rights, rule of law, and civil liberties around the world.

Should the USA become such a flawed democracy themselves, their soft power around the world would diminish in favor of actors such as China and the Russian Federation. In the case of Nigeria, it makes much more sense to ban Bitcoin for the local fiat currency, but people can measure hours of work or certain commodities according to the BTC supply that they can access. Should a government ban Bitcoin, it would effectively encourage the establishing of black markets, Which drives up adoption beyond the authority’s control and reach. After all, the software is open source and nobody can stop the users from distributing and even reproducing from scratch all the elements necessary to interact with the Bitcoin network. From a game theory point of view, it is better for the government to facilitate Bitcoin adoption within its control.

Collecting information about users though legal private companies helps them also collect taxes. Also, allowing a certain degree of liberty will make the regime look a little bit more freedom-leaning – thus strengthening its legitimacy and reducing the likeliness of a coup, the purpose of regaining control over the money printer and reestablishing faith in the money. After all, increasing the supply only makes sense if there is real demand for the money. And any form of currency which offers an escape from the existing power structure needs to be crushed by those who want to stay in government while retaining the hegemony of an older system.

Nevertheless, it is also in Nigeria’s best interest to receive capital inflows and be a part of the global economy. And for thousands (if not millions) of freelancers, there’s a real opportunity to work remotely and get paid in a better form of money – which of course would get exchanged in the local currency to buy food and pay for living expenses.

Therefore, even if central banking policies would suggest that a strict ban on Bitcoin is temporarily the best alternative, the economic dynamics of supply and demand say otherwise. So it’s better for developing nations like Nigeria to actually allow the youth to use Bitcoin, as long as the central bankers can maintain popular faith in their funny money.

Otherwise, the situation turns into a full-blown Bitcoin takeover (pun intended) in which the non-governmental digital currency is the Trojan horse for freedom of transactions and the collapse of central banking.

From a geopolitical point of view, Bitcoin is an instrument for blackmail.

Nation states are under permanent threat that, if they don’t allow it to exist, their neighbors will – and therefore these nations will absorb a greater degree of capital from the global markets and develop at a higher pace. Nobody wants to fall behind in the race for innovation. And if the price governments must pay is that of enabling Bitcoin to exist, then they would much rather make this compromise.

There’s also a case to be made for regional alliances, international trade federations, and confederations. On a surface level, these forms of government are more likely to collaborate towards achieving a common goal. If they decide that Bitcoin is a big threat, then they will find ways to ban it. However, there are two facts that deem such an agreement unlikely:

- First of all, even federation/confederation/alliance members compete with each other from an economic point of view and it’s hard for the lesser developed territories to simply give upon extra means for wealth creation only to comply with the will of the others. In order for an agreement to be made, the more developed and wealthy members of the supranational body would have to make serious compensatory concessions to the others. This scenario is unlikely to work over the long term, though;

- Secondly, no international government organization (including the United Nations) has a membership large enough to cover all sovereign nations. Palestine, Kosovo, Taiwan, Hong Kong, and Western Sahara are only five examples of countries that are not part of the UN. For as long as at least one of them remains neutral from global policies (which is very likely, granted the tax haven status of many of them), Bitcoin will continue to work as designed. And the fact that one nation benefits from the prosperity that Bitcoin brings will only accelerate the adoption race among its neighbors. The best time to ban Bitcoin was probably in the first 4 years of its existence. Before users discovered the virtues of self-custody after the Mt. Gox fiasco, before node operators showed their resilience against big companies that wanted to increase the block size via hard fork in 2017, and before miners successfully migrated out of China in 2021. All of these are examples of resilience and persistence. At this point, Bitcoin is a global financial phenomenon. It has changed people’s lives to the extent that these individuals are willing to fight to defend the network. It’s also the kind of honest money that holds governments and central bankers accountable by making them aim to print less money…granted that they care about the long-term survival of their fiat currencies. As the Nakamoto consensus dictates, it’s more economically rational to become an honest actor in Bitcoin’s mission than to fight against it. Governments are not exempt from this axiom – which is why they use FUD to buy themselves more time (and program AI software to push their agenda).

Sorry ChatGPT, you’ve lost this one!

Vlad 1ChatGPT: 0″

Vlad has slain the “muh government is gonna shut down Bitcoin” fears of ChatGPT!

I’m Charles Polanski and I seek to turn the Bitcoin-curious into Bitcoin investors and enthusiasts.

Thanks to Vlad for making this excerpt available to freely spread.Find him on Twitter: @TheVladCostea

“Your Bitcoin influencer’s influencer.”

Host of the Bitcoin Takeover Podcast

Writer of the open source @btctkvr mag.

Check out his work: http://linktr.ee/btctkvr